The Swiss Life Group has been offering investment components for company pension schemes and solutions across all relevant implementation channels for several decades. Our customers can choose from flexible and modern investment solutions for lifecycle models, collective models, lifetime working accounts and pension companies.

With our company pension scheme platform, you receive a custom-fit solution from a single source, such as asset manager and insurance solutions, or two de-risking options (de-risking with capital investment and de-risking through an insurance solution). However, even a good standard solution does not fit every company or every pension plan payout option. For this reason, we develop individual solutions for both lifecycle and collective models – advantages that also benefit our own employees: In early 2020, we redesigned and successfully implemented the entire pension landscape of Swiss Life Asset Managers Germany. Employees receive a direct commitment, which is funded through our CTA SLAM Trust.

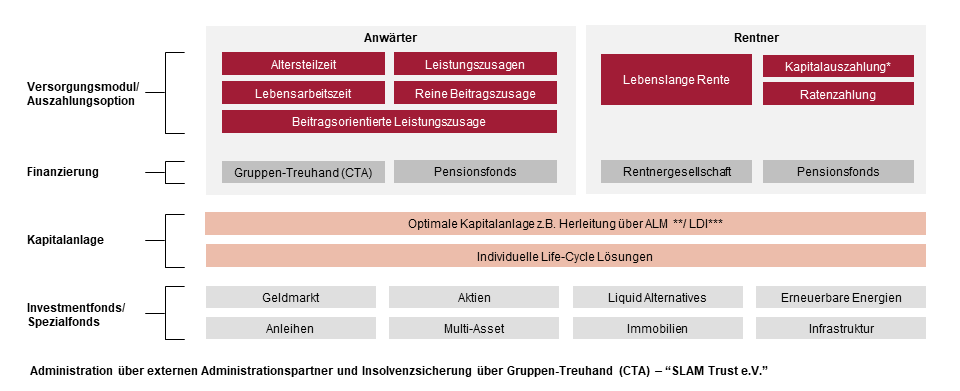

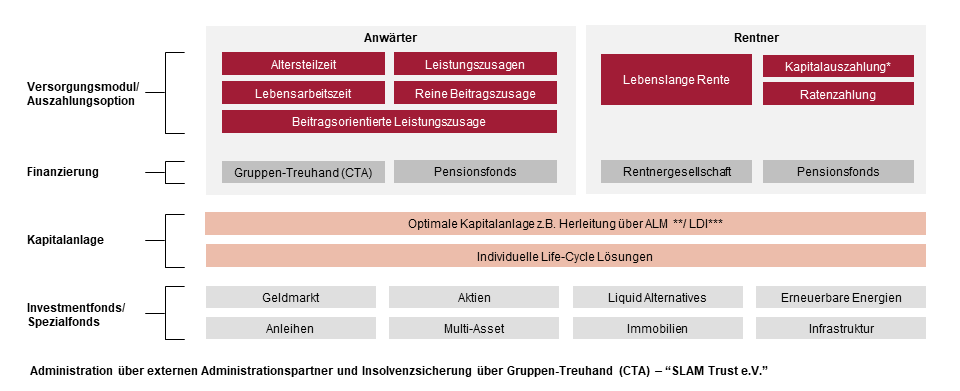

Overview of our investment and pension solutions services

Quelle: Swiss Life Asset Managers, eigene Darstellung, *Anschließende Finanzberatung via Swiss Life Gruppe möglich. **ALM = Asset Liability Management. *** LDI = Liability Driven Investments.