SLAM Trust e. V.: Balance sheet advantages and more security for occupational pension schemes by outsourcing pension commitments to a group trust.

In the competition for the best minds, many companies offer their employees a company pension scheme (bAV). But what happens to the assets used for this purpose if a company gets into financial difficulties, is taken over or has to file for insolvency? A Contractual Trust Arrangement (CTA), a model for outsourcing pension obligations to an external trust company - such as our SLAM Trust e. V. - offers protection against such risks.

There are good reasons for companies to offer their employees a company pension scheme. The elementary building blocks should be in place for both employees and managers.

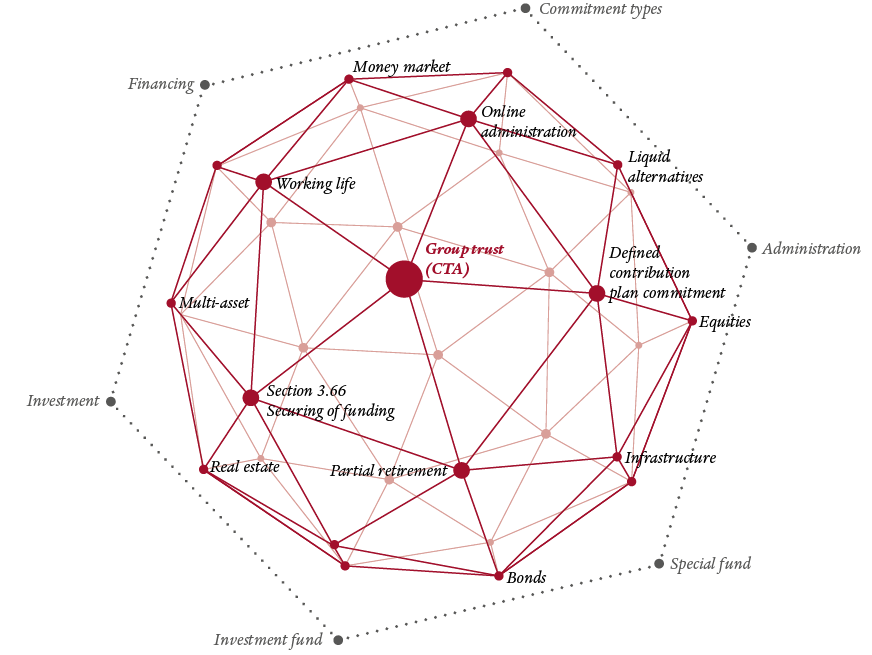

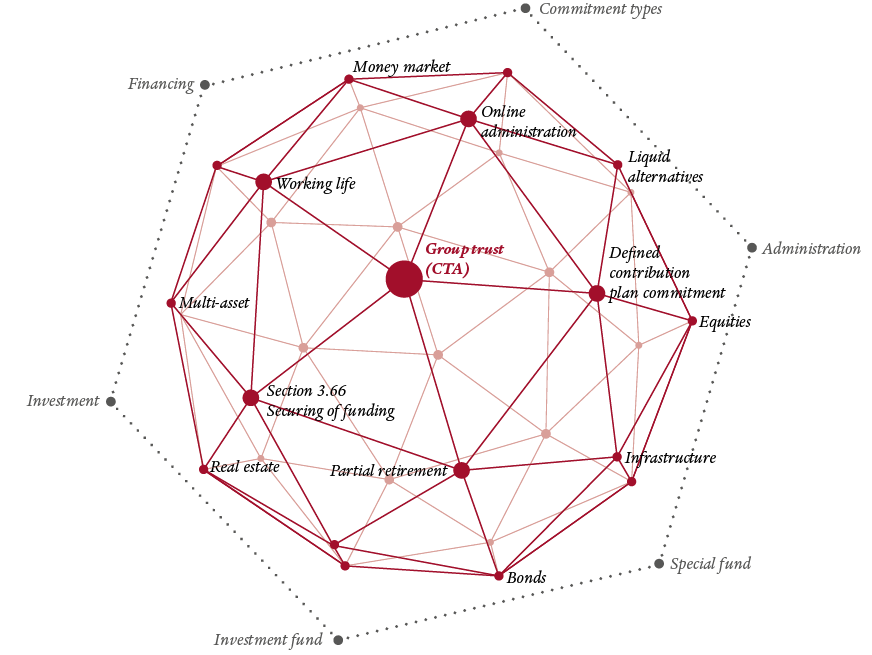

The group trust as the central point of your supply landscape

When or why companies should think about a group trust

- Little involvement with the topic of "re-financing" your occupational pension scheme (bAV)

- The company has funding gaps

- Accounting standards change

- The company has its own Contractual Trust Arrangements (CTA), but too few resources to manage it

- Increasing decision-making burdens

- You would like to introduce a new pension module (e.g. a new pension scheme).

- Low investment returns and the feeling of not having invested in line with the times

- The result: you are pressed for time in your daily work and thus have a shortage of resources for all these issues.

Your advantages at a glance

The competition for the best minds continues to pick up speed. But the urgently needed qualified professionals have a choice - and a rewarding, secure occupational pension scheme is an important argument.

But what happens if a company gets into economic difficulties or, in the worst case, has to file for insolvency? It is challenging to build up earmarked assets for employees in such a way that the pension obligations from the company pension scheme are protected against insolvency and reduce the balance sheet.

- On request: outsourcing of all administrative activities

- Certified insolvency protection

- Protection of assets in the event of insolvency

- Protection of assets in the event of company takeovers

- Protection of assets in the event of insolvency

- Outsourcing of external risks

- Balance sheet reduction (HGB/Bil- MoG/IFRS/US-GAAP) through the build-up of plan assets (bAV)

- Conception of a contemporary and professionally managed capital investment

- Resource-saving outsourcing of original CTA activities

Good reasons for our CTA solution at SLAM Trust e.V.

- The implementation of our group trust is efficient and accompanied by experts.

- We have renowned cooperation partners - but are also happy to work with existing providers. We are flexible and adapt to the needs of our customers.

- The group trust extends the statutory insolvency protection.

- Design of a contemporary capital investment and access to a variety of asset classes (including bonds, equities, real estate as well as infrastructure).

- We have been a stable partner to companies for over 160 years and therefore understand the interests of management, works councils, human resources, treasury and finance.

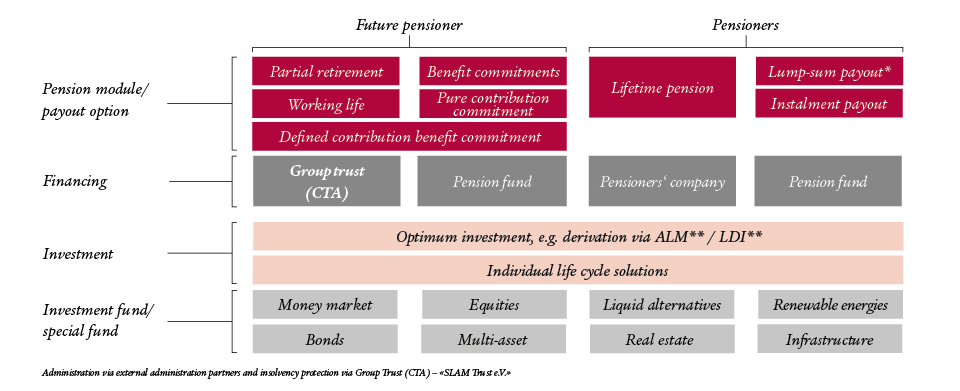

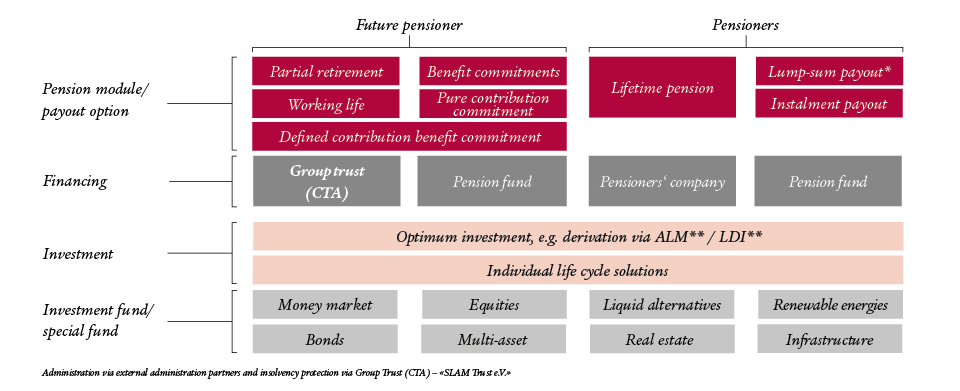

The path to professional CTA capital investment

Our asset liability management helps you to gain more transparency about the numerous factors influencing the financial and structural situation of your pension institution.

The aim is to show in detail, by means of a realistic projection of the assets and liabilities, the opportunities and dangers in connection with the choice of asset allocation and the risks of provision. In addition, proposed solutions for risk reduction are discussed in the next step and recommendations for asset allocation are derived from this.

Quelle: Swiss Life Asset Managers, eigene Darstellung, *Anschließende Finanzberatung via Swiss Life Gruppe möglich. **ALM = Asset Liability Management. *** LDI = Liability Driven Investments.

The SLAM Trust e.V. offers double protection: for the balance sheet of the company and the retirement provision of the employees

More and more companies in Germany are preparing their balance sheets according to international accounting standards. However, company pension commitments can prove to be an obstacle in this process. With SLAM Trust e.V., we offer companies the opportunity to build up earmarked assets and thus secure their pension obligations from the company pension scheme in a way that shortens the balance sheet and protects them from insolvency.

Joining the group trust of Swiss Life Asset Managers offers double protection: for the company's balance sheet and the retirement provision of its employees. From a cost-benefit point of view, it is worthwhile for companies with 500 or more beneficiaries and 1000 or more employees.

Swiss Life Asset Managers Trust e. V. and its members benefit from 160 years of experience of the Swiss Life Group in institutional asset management. Our investment philosophy in third-party asset management aims for security and is based on a risk-conscious culture with which we protect and grow our investors' assets. We use a broad range of investment solutions in the asset classes of real estate, bonds, multi-asset, equities and infrastructure.

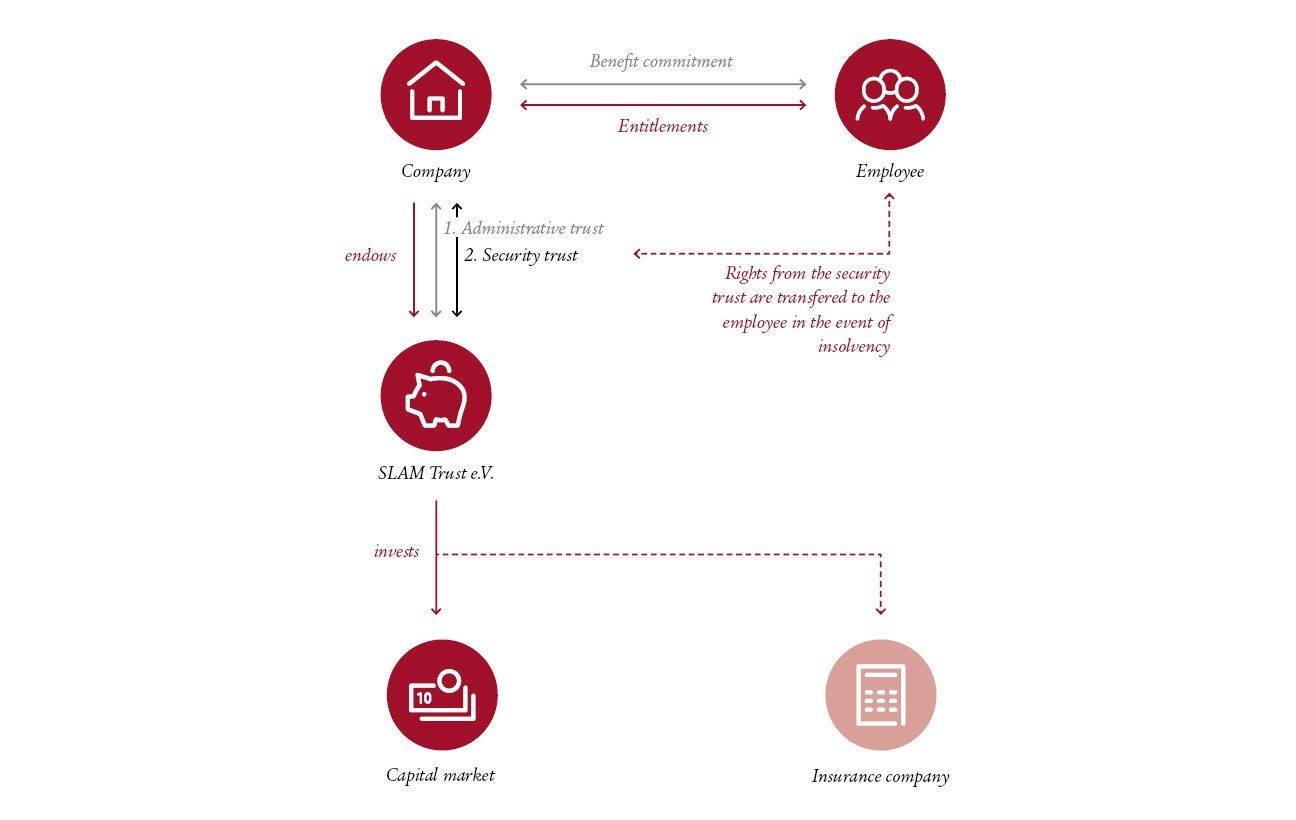

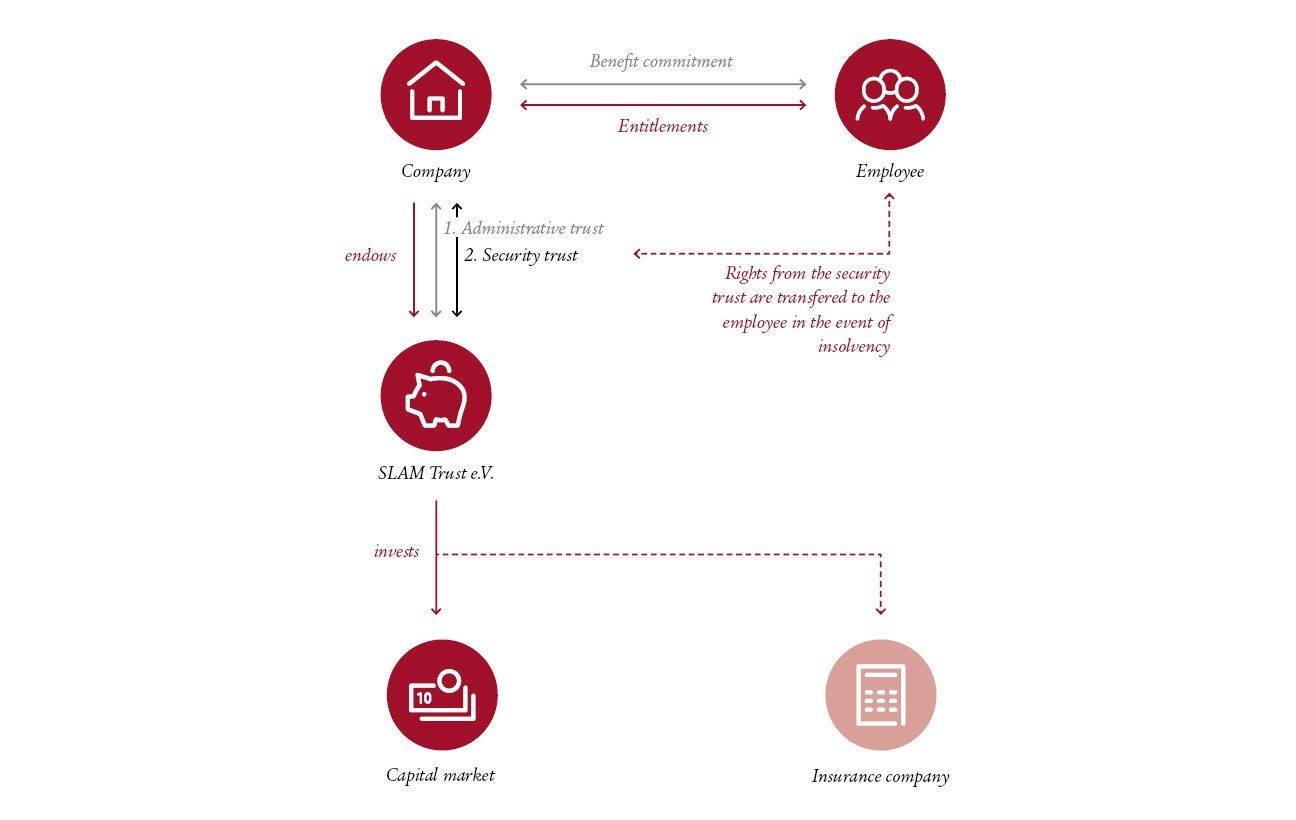

The mode of operation at a glance

Administrative trust

It governs the formal transfer of funds to the trustee and administers them in trust.

Security trust

A contract in favour of third parties (necessary for recognition as plan assets).

The employee acquires a claim against the trustee for payment of the pension benefits in the event of insolvency of the company.

Contact

Let our experts explain the possible advantages of outsourcing your occupational pension provision. Free your tax and commercial balance sheet from pension provisions and eliminate fictitious profits - completely or through tax-innocuous partial outsourcing. We will be happy to advise you.

Alexander Klein

Vorstandsmitglied des SLAM Trust e.V. und Syndikusrechtsanwalt

Tel.: +49 89 231 221 431

E-Mail: alexander.klein@swisslife-am.com

Albrecht Graf von Bassewitz

Head Investment and Pension Solutions Germany / Sales Director - Institutional Clients

Tel.: +49 69 240 03 14 49

Benno Jöckel

Senior Sales Manager – Institutional Clients and Pension Solutions

Tel.: +49 69 97908 546

E-Mail: benno.joeckel@swisslife-am.com

Erik Lavagno

Client Relationship Manager – Institutional Clients and Pension Solutions

Tel.: +49 69 240 03 14 33

E-Mail: erik.lavagno@swisslife-am.com