The slump in US commercial real estate is weighing on small US banks, but we do not expect a systemic crisis. Southern Europe continues to be more dynamic than the eurozone core countries at the start of 2024. China: Domestic travel reaches record levels, yet real estate sector weakness is weighing on consumption.

Chart of the month

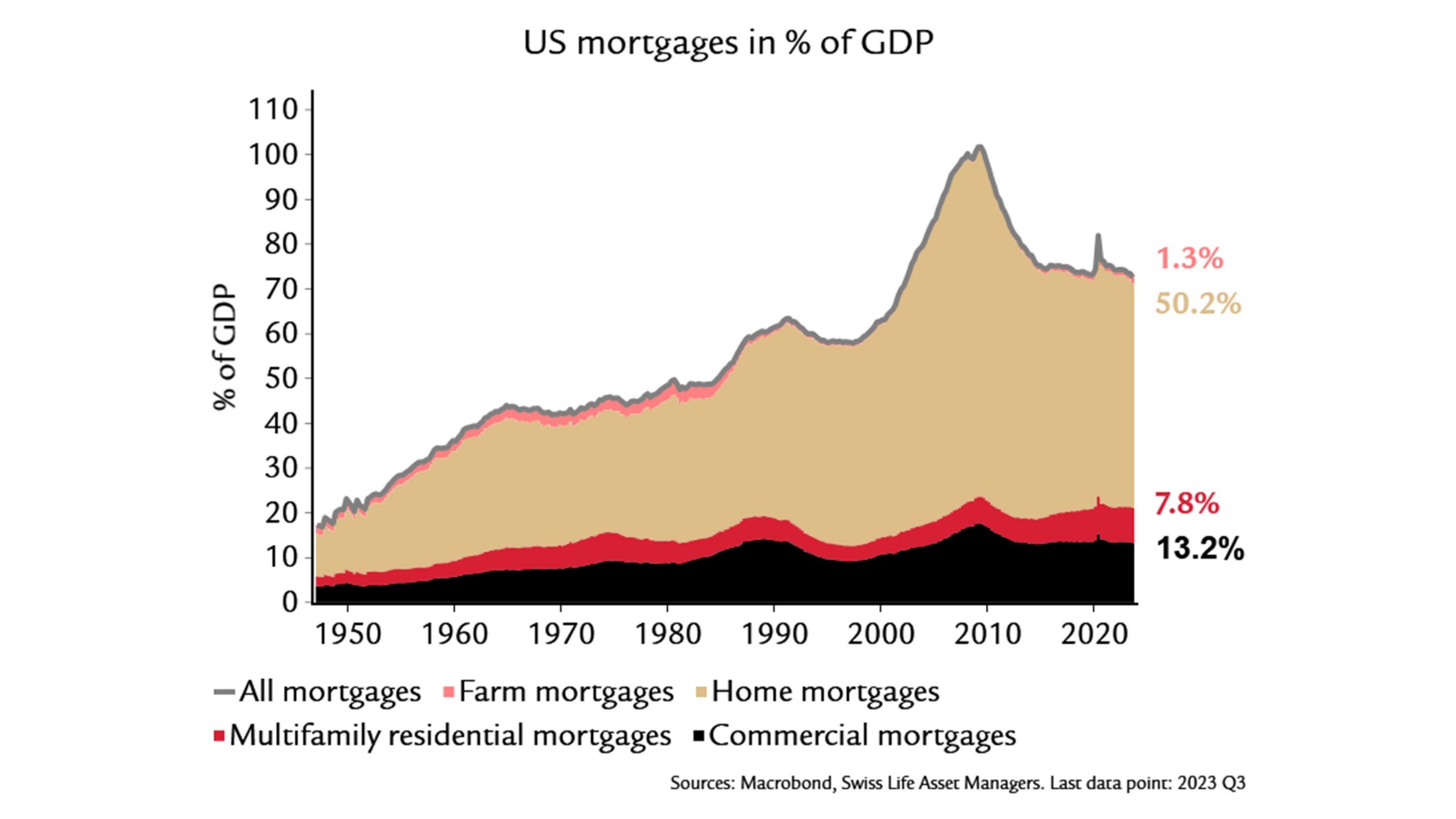

US commercial property prices have plummeted in the major centres. Higher interest rates and, in particular, under-occupancy due to home working took their toll. However, the following arguments suggest there will not be a repeat of the 2008 financial crisis: (1) Mortgages for commercial real estate account for only 18% of the overall market and have been stable relative to GDP since 2014. (2) There are no signs of weakness in the much larger residential mortgage market. (3) The central bank and banking supervisors are aware of the problem and would probably intervene at the slightest sign of systemic stress in the US banking system.