Emerging markets boosted by global economic recovery, but higher interest rates pose a challenge. ESG considerations are valuable when assessing a country’s long-term economic stability. China: focus shifting towards quality growth, innovation and self-reliance, as external risks are growing.

Number in focus

After less than five months in office, Turkey’s marketfriendly central bank governor Naci Agbal has been ousted. While he aggressively raised the policy rate by 875 bps, which strengthened the lira considerably, the appointment of his successor Sahap Kavcioglu – a critic of interest rate increases – led to a plunge in the lira by more than 15% against the US dollar. Turkey’s economic fundamentals deteriorated over 2020, with a tremendous sell-off of foreign exchange reserves and a pile-up in short-term foreign debt. A shift towards an unorthodox monetary policy regime increases the risk of a renewed balance of payments crisis in the country.

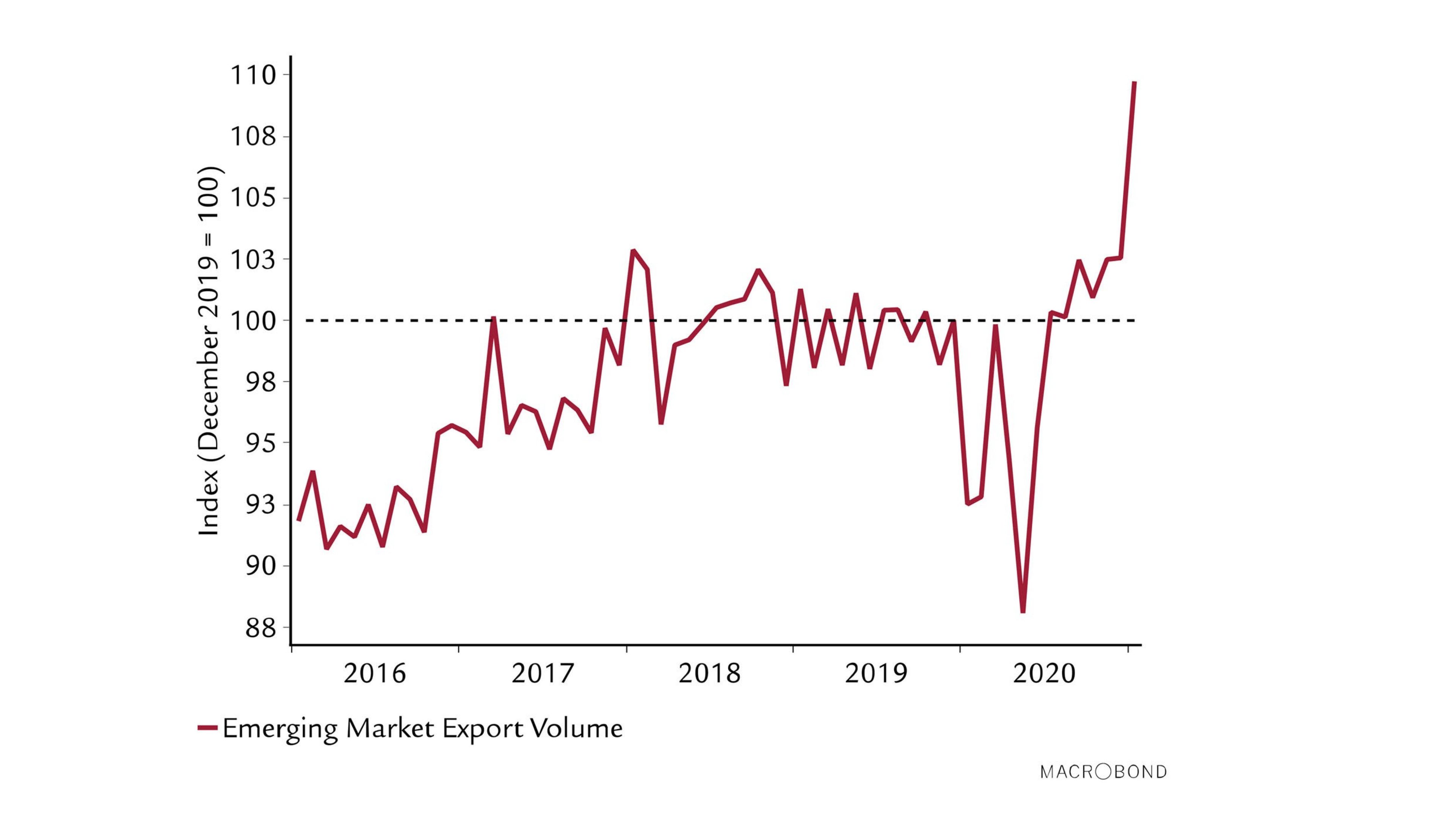

Chart in focus

Emerging market exports had already surpassed prepandemic levels by the end of 2020 and they experienced a real boom in January this year. The expected ongoing global progress in vaccinations as well as an economic rebound in the US, supported by a large fiscal stimulus package, will likely boost demand for goods produced in emerging countries and support their economic recovery. Nevertheless, as vaccine progress in major developing countries remains slow, social distancing measures will continue to weigh on the services sector.