Economic downturn to bottom out in the first quarter 2020 amid monetary and fiscal support. Ongoing political uncertainties and a structural slowdown in China to hamper substantial rebound. Latin America: social unrest in Chile and Colombia to hit economies.

Number in focus

This year the Turkish central bank delivered rate cuts of a total of 1000 basis points. Loose monetary policy coupled with fiscal support and a stabilising currency helped to move Turkey out of recession, with third quarter GDP expanding by 0.9% from a year ago. However, a swift rebound of growth in 2020 is unlikely as (geo)political risks remain elevated. The government is targeting a 5% growth rate next year and the stimulus package needed for this, is likely to create fundamental vulnerabilities.

Chart in focus

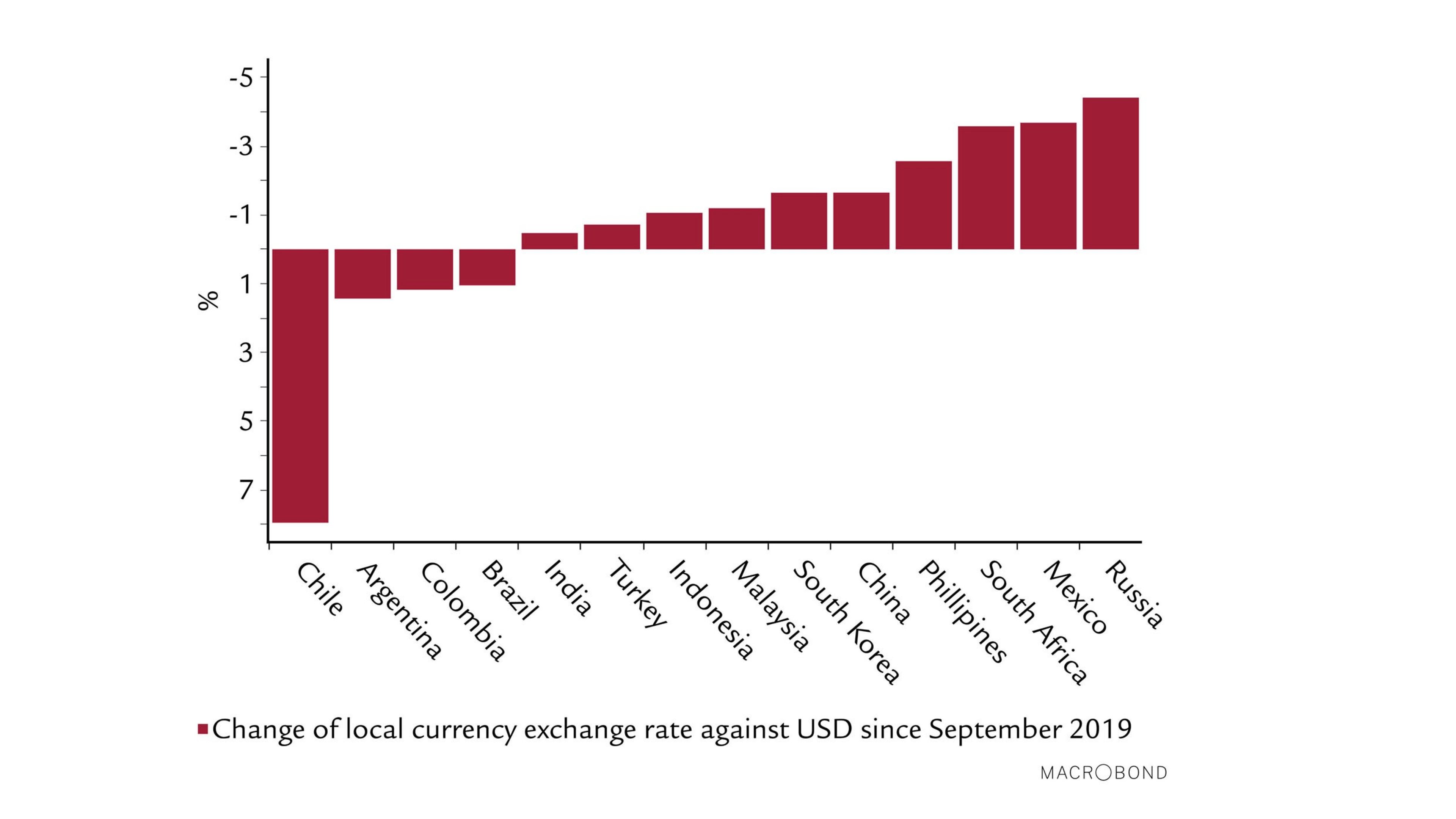

Major Latin American currencies tumble as social unrest is spreading across the continent, most recently in countries such as Chile, Colombia, Ecuador and Peru. While protests have been kindled by unique domestic issues, contagion has pushed down the currencies in the region. Central banks in Chile and in Brazil have started to sell dollars in order to prevent a sharper depreciation. Social turmoil that is here to stay will likely lead to a sharp downturn of economic activity.