US: Banks could become more cautious with regard to lending and tighten financing conditions. Eurozone: Strong economic figures and a resilient banking sector, but growth drivers are coming to an end. China: Retail sales and the real estate sector are showing initial signs of stabilisation.

Chart of the month

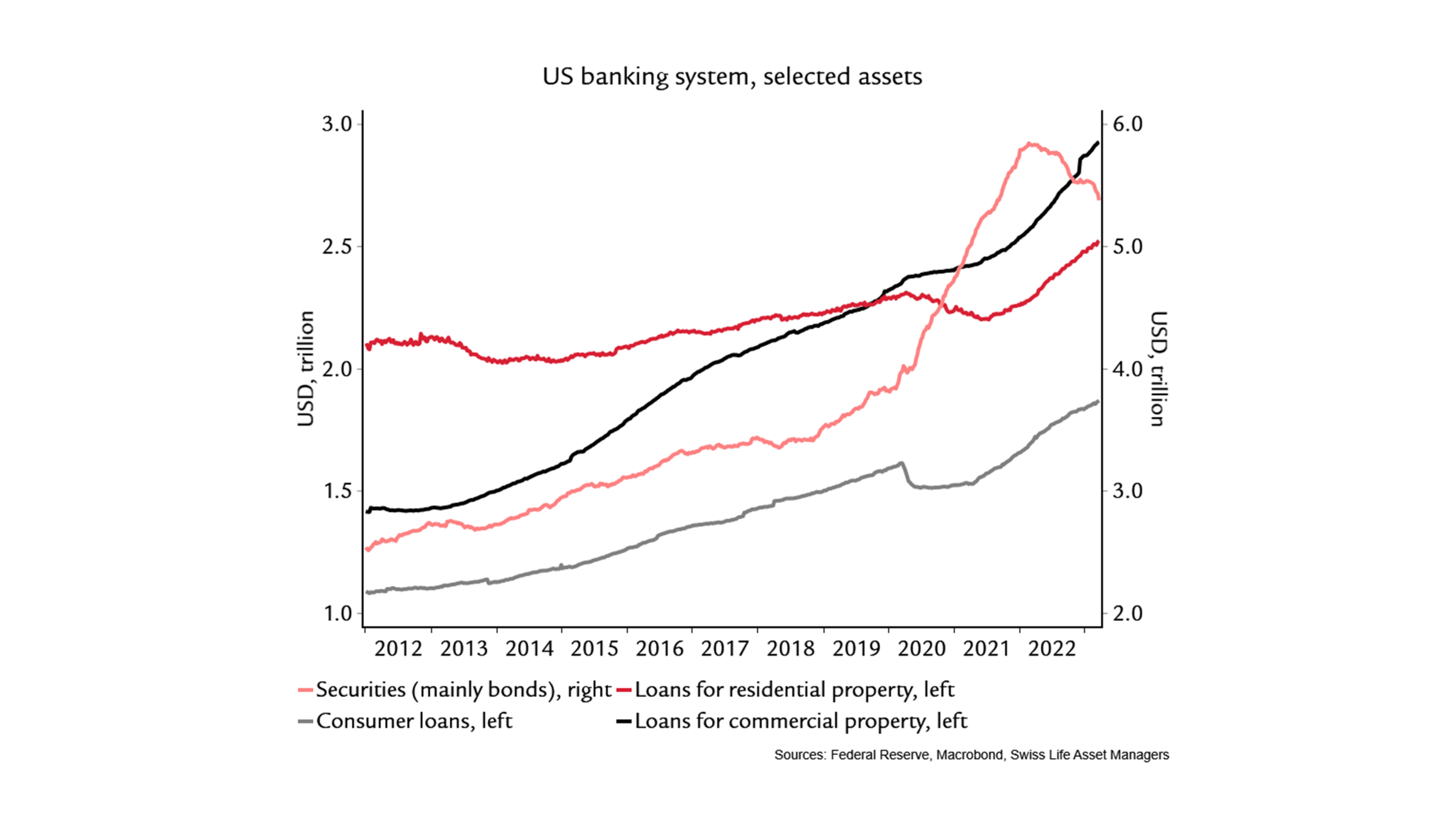

Due to the rise in interest rates, US banks are record-ing large accounting losses on safe bonds – precisely the asset class in which the banks “parked” a lot of money in 2020 and 2021. Interest rate risks are not a problem if properly hedged, as the quality of these investments should remain high even in a recession. Losses in credit quality or even a credit crisis are much more problematic during downturns. The biggest credit boom in the past ten years has occurred in commercial real estate – an area in which regional banks are very active. As a result, the focus of the financial markets is likely to shift strongly towards this sector in the coming months.